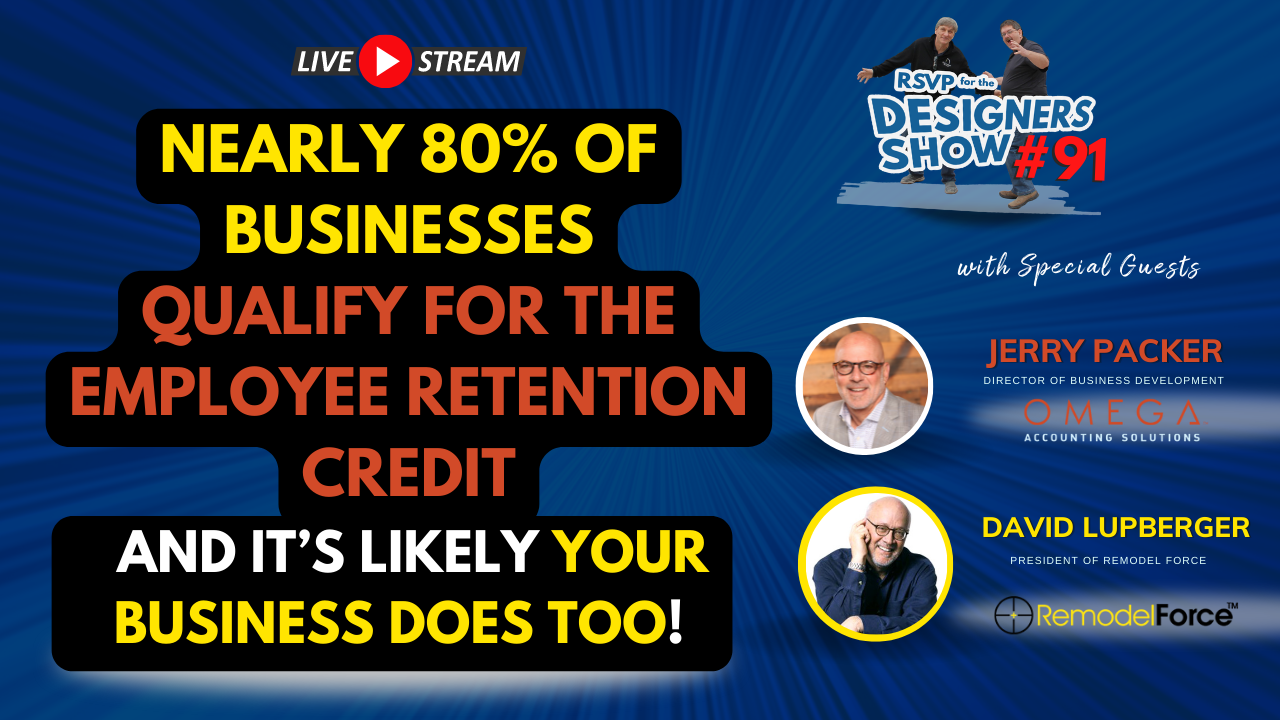

Got Employees? You Could Qualify For Some "Serious" Left Over Covid Dollars! Designers Show #91

designers show Dec 07, 2022

In this special edition of the Designers Show, David Lupberger from Remodel Force and Jerry Packer from Omega Accounting Solutions join us to give you the facts about the ERC Tax Credit and show you the simple way you can find out if you qualify. There are only a few simple steps to getting this "found money" for your business!

Introduction 00:01

Cares Act Background 04:58

ERC Tax Credit Structure/Requirements 06:15

1st Path to Qualify: Decrease in Revenue 10:00

2nd Path to Qualify: Disruption of Business Activities 12:58

Common Misconceptions 17:41

Omega's Process 18:31

Omega's Responsibilities 24:59

Beware of "ERC Mills" 27:05

Omega, Your Trusted Advisor 29:19

Question: Do Family Members Qualify? 35:33

Comments & Wrap-Up 36:04

Registration is Open for the 2023 Chief Experts Summit!

Elevate Your Chief Architect & Design Business Skills

Virginia Beach, VA | February 2023

Chief Experts Total Immersion Summit For Chief Architect Users

LEARN MORE ABOUT THE SUMMITall right we're live hey welcome everyone uh Dan here with Chief experts and I'm I have the privilege today of being online with David luperger and Jerry Packer and uh we're going to talk about the employee retention credit which I had no idea what it was until David told me about it so once he told me about us like yeah I got to let you guys know about this because if you've got employees this is a big deal I just got off the phone right before you guys logged on with a long time client and a very close friend of mine Jared Beamer in Seattle who had said that yeah in August he as the Colin mentioned it to him and so he went through the application process he's got 140 000 is this like oh Merry Christmas to you yeah so that was pretty cool um and that's exactly what you guys are going to talk about today so let me uh just uh real quickly um let me just screen here and so again you you're going to talk about the employer retention credit and just a little bit about uh David David's good friend of mine we've been we go way back I mean way back we used to do yeah we did a lot of webinars together in the day and just yeah we've had a good good time together and we're part of a mastermind group together and just really enjoy it and I've gained a lot from David's experience and knowledge and hopefully vice versa so yeah but when David told me about this it was like yeah we got I got to tell you guys about this so Jerry who is uh going to be doing this presentation is the uh president of Omega accounting Omega accounting so Jerry maybe you could give a little bit of information about you know your firm and what you guys do unless that's part of your presentation maybe it is and I just want to say Dan I appreciate the uh the promotion I'm actually the Director of Business Development okay so I am not the owner although I wouldn't mind being the owner I am not the owner okay got it so uh cool well let's uh let's just jump into uh your presentation here what's my motion being funky what's going on cut it all right oh I'm on the wrong screen all right here we go helps if you're on the right screen uh all right cool so Jerry just jump into it uh everybody that's on the call here if on the meeting if you have questions feel free to type them in fact if you wouldn't mind just typing in where you're from uh and say hi uh I'd appreciate that and uh Jared just have at it because again one thing Dan yeah is that uh you know this is kind of a high a 30 000 foot view of the employee retention credit okay Jerry will review the program and the different elements and how to qualify and if if people have questions please post the question and we'll answer every question at the end of the webinar perfect great thank you and David uh is there going to be uh an email sent out yeah Dan you're gonna oh yeah I'll follow up with emails to everybody and then I'll give them access to the recording too so absolutely um so that'll be cool and uh right so I was just going to say something I totally spaced on it but um Jared just tab at it okay so Dan uh just to make sure so everybody just can see the screen right now yep great wonderful alrighty so everyone thank you um as Dan said my name is Jerry Packer I'm the Director of Business Development at Omega Accounting Solutions we uh have been around since 2007 we're located in Irvine California we are experts in tax credits we've been doing r d credits some of you might be taking advantage of the r d credits uh which we work with a lot of builders on um because we do r d credits we are uniquely positioned to handle um ERC credits when the cares Act was established um we have as I mentioned been on business a little over uh 15 years we uh earned the designation of one of the fastest growing private companies in Orange County by the Orange County Business Journal we are a top workplace to work in 2021 and we have an A-Plus rating with the Better Business Bureau with zero complaints filed as of the last time I checked which was a couple weeks ago um to say that you know what you're talking about would be an understatement I take uh you know you've been doing this for a while hopefully people won't believe me today no I'm kidding uh yes so we do know what we're talking about we we are an accounting firm we are sorry about that we uh we do not do tax and we not do not do audits so we've kind of specialized in uh accounting and tax credits cool um when the pandemic hit there was something that the care called the cares act that was uh enacted by Congress a response to the pandemic it created two mechanisms that were stimulus for businesses and in you know I'm I'm not the the youngest guy out there and as long as I can remember there has been government stimulus you know I've talked to business owners who have said you know I don't want anything I don't want to hand out this is not a handout this is actually uh a refund on wages you paid during uh to keep your workers employed during the pandemic now as I mentioned there's always been stimulus but it's always been geared towards the big guy towards Big Business it was the banking industry the automotive industry the airline industry this is the first attempt and I'm really successful at getting stimulus to the small business owner nice it started out with PPP and at the time when the cares that came out there was PPP and the employee retention tax credit or ERC you could not do both everybody did PPP nobody really knew about ERC so everybody decided to go uh PVP now uh the employee tax retention credit is a is it credit um for a uh is a refundable tax credit it's based off of wages it's actually claimed through the 941 which you normally file at the end of each quarter declaring your wages that you've paid and the taxes and what we do is we file an amended 941 which is called the 941x businesses qualify by quarter so it's not done for a year it's done quarter by quarter by quarter so in a year you might qualify for one quarter and and not another uh so it doesn't just it doesn't disqualify you if you don't qualify for let's say quarter one but you do qualify for Quarter Two there are two tests to qualify the most widely known test is the revenue test which I will get into and the one that's uh really uh little known is the nominal disruption uh path now the program is set up uh and it's all based around W-2 employees so if you have 1099 employees they do not count and you as an owner if you W2 yourself if you're a majority owner and if you have family that works so if you have a spouse or children that work for you that are W2 or that are W-2 they do not get included in the calculation so they're excluded so 10.99 and owners are excluded from this um question no I I said darn okay yeah right because I I know I'm self-employed yeah my business at unemployed so it's like again this is geared towards businesses that have employees that get their employees working during the pandemic so it started out that it was a maximum of 20 of 100 W-2 employees you could claim up to 50 of the ten thousand dollars in wages per employee for per year so in 2020 what all of that means is you could get a maximum of five thousand dollars per employee now in 2021 there were several amendments made to the to the cares act namely ERC first one was is that if you would if you had applied and received PPP funds you could now apply for ERC second is that it goes up to 500 employ W-2 employees but most significantly the change that was made um is that you could apply for up to 70 000 or some excuse me seventy percent of ten thousand dollars for the first three quarters so what does that mean in English it means this you can qualify for up to seven thousand dollars per employee for the first three quarters of 2021 for a potential total of twenty one thousand dollars so if you've seen ads or you've heard ads on the radio about you know get your twenty six thousand dollars the re the way that that comes up or the way that the the twenty six thousand dollars is calculated it's five thousand for twenty twenty and it's twenty one thousand for twenty twenty one equals twenty six thousand dollars now in order to qualify for the max your employees need to make a minimum of twenty dollars an hour and a full-time equivalent is considered 130 hours um that we don't really need to get into that because part-time employees also count so their wages account so if you double it to part-timers they will count um two paths to qualify as I mentioned the first one is a decrease in Revenue this is the path that's a little uh more known than the second path so how does it work it's done on a comparable quarter basis against 2019. 2019 is always used in the comparison as the Baseline so let's take for example Quarter Two of 2020 compared to Quarter Two of 2019 you have to show a 50 drop in Revenue that's not income so it doesn't take expenses into account it's just what you brought in Revenue compared to 2019. so that's a pretty good job you have to have been impacted pretty severely to show a 50 drop and one of another amendment of The 2021 amendment that Congress did was they lowered the threshold so the drop only had to be 20 in 2021 compared to 2019. so q1 of 2021 you had to only show a 20 drop uh against q1 of 2019. the same happens for Q2 and for Q3 there is no Q4 for 24 or for for 2021. again no Q4 the release is Congress uh eliminated that to help pay for the uh infrastructure bill so only Q one two and three for court or for 2021 with a maximum of seven thousand dollars per Q one two and three now you might do a back of the envelope calculation and say wow I didn't drop by 20 in uh and Q in Q2 of 2021 compared to Q2 of 2019. that's okay because the government the IRS has given us an additional calculation that could be advantageous to business owners called the alternative quarter election rule which means we can use different quarters as opposed to the same quarter of 2019 if it's more Advantage advantageous to you so we might be able to use let's say for q1 of 2021 we might be able to use Q4 of 2020 if it's more advantageous then it can qualify you so my point is if you do a back of the envelope you don't think you're qualified don't be discouraged because there we could potentially qualify you using the alternative quarter election rule all right that's the decrease in Revenue the second path to qualify has nothing to do with Revenue your Revenue could have doubled or tripled or quadrupled and you can still qualify for ERC using this path the government's term is full or partial suspension of operations that is misleading because you don't have to have fully or partially suspended your operation but you have had to have experience was a nominal impact to business operations as a result of covid or a government mandate that affected your business typically stemming from social distancing limited capacity supply chain issues due to covet permit or inspection delays reduced operating hours limited amount of workers on the job site employee training etc etc so let me explain so let's say and I'm gonna get this wrong because I am not in the trade and I don't understand how you guys actually do business but I'm going to oversimplify this let's have a drywall company and I do a job let's call it ten thousand square feet and I bid it in in 2019 and I know how long it's going to take because obviously I'm I've got some idea because I've got to bid it I got to know that I can make money so I've got an idea of how how much a square foot or a thousand square foot or ten thousand square feet actually takes how long that's going to take so let's say in 2019 I do a 10 000 foot drywall job and it takes me a week to do that job but be in covid during covid because of either I can't get materials or I can't keep as many uh I can't put as many workers on the job uh so I'm not as effective so that 10 000 square foot job now takes me two three weeks to do or three weeks to do because of something related to covid I've been nominally impacted by 10 or more therefore I might have made the same amount of money or I mean I might have charged the same amount of money might even charge a double so I might have my Revenue might be up but because it took me two or three times as long longer to do than it did before covet started I have a metric that I can show that we can actually show we can quantify it and we can um qualify you through that that path other things are supply chain interruptions let's say you you you're delayed on a job because you're waiting for for supplies that are being held up either because they're sitting in a port because that has slowed down because of uh social distancing or because your manufacturer has had to either suspend their operations or they had to slow it down because they had to space out their manufacturing floor or they had supply chain interruptions so we can go upstream and we can actually show that um that there was supply chain interruptions Upstream that actually affected you and created um delays um or made you less effective that we can quantify so if you have any questions on that write them in the chat box and we will discuss this at the end yeah and can I just add a couple notes to this David feel free yeah because look in all honesty I don't know any contractor that didn't have some disruption of service and it could be due to permit offices closed you couldn't get inspections done it couldn't be you couldn't I'm sorry you couldn't get permits approved you couldn't get the permit it could be uh inspections were delayed because inspectors were not going on site um as you mentioned it could be waiting for materials because of a hundred and nine permit uh container ships sitting in Long Beach Harbor waiting to be offloaded and they couldn't do it quickly due to social distancing if you and you can help people with this if you can show that you couldn't produce work in the same efficiency in 2021 that you did in 2019 you qualify correct correct so moving on thank you David because there were so many changes to ERC there are a lot of misconceptions and I hear it over and over and over again when I'm talking with business owners and that is yeah we looked into it or we talked to our CPA or we talked to our payroll company and we don't qualify because business was up as I just explained and as David reiterated that is not necessarily A disqualifier I also hear we received PPP funds so we don't qualify again that change or that was changed so you could receive ppv funds and still qualify and lastly we were deemed essential we didn't shut down we don't qualify again not a disqualifier so how do we work you're going to be sent a link after this and uh if you're interested we ask you to fill out your information and submit and one of our Representatives will contact you they're going to have about a 10 maximum 15-minute conversation with you and learn about your situation they're going to ask you some questions and they're going to try to identify any disqualifiers right off the bat if they don't see any they're going to walk you through our process and should you want to proceed we're going to send you a sales agreement or a service agreement which you will execute electronically we're then going to ask for a refundable retainer of approximately 750 now why do we ask for a retainer especially if it's a nominal amount and if it's refundable well that's a good question the reason is because we want you to have skin in the game as the business owner we want you to place a value on it if you place a value on it we're not going to spend all of our time chasing documents that we need to actually start the process and once we start the process we may have questions so we're going to get our phone calls answered we're going to get our emails returned in the very beginning we didn't charge a retainer and we wasted a lot of precious time that we could be doing filing and doing analysis as opposed to chasing down documents and um trying to get answers so we want you to have skin in the game once we go through the process if we determine you do not qualify you get 100 of that retainer back so there's absolutely no risk if we do determine that you qualify we keep that money and we apply it against the fee that you are going to pay us on the back end when you receive your money from the IRS from the Department of Treasury you do not pay us before then how do we get compensated we charge a 15 fee of the credit that you receive from the government if you have 10 employees or more again W2 not including ownership we charge 25 for five employees to nine employees and we just can't do under five employees why because we can't make any money and you're not going to do a job that you lose money on and we don't want to do a job that we lose money on we we're just trying to cover our our expenses on the 25 fee why we have CPAs on staff we have about 15 attorneys on staff these are the people that go through the analysis that do the research that sign off on it before we actually file so you can believe or know or have confidence that we are doing it directly and if you are to get audited somewhere down the road that slim chance but it is a chance that we will hold up to an audit so if we go through all of that you sign the agreement you give us the the uh 750 refundable retainer we're then going to go through document collection this is stuff that you can these are these are materials that you can get from your bookkeeper your accountant your some of it from your payroll uh service if you're using a payroll service the first one is we need pay we we need P L's by quarter so we need Q one two three and four of 19 20 and 21. uh if you do QuickBooks or any uh type of um Accounting Service that you're doing um or software that you're doing yourself you can run this in about 10 minutes your bookkeeper can run it just as quickly uh so can your accountant uh payroll reports your bookkeeper if they're doing payroll or your payroll service can provide you with those um we need if you are do if you are offering as a benefit to your employees if you are offering health care we're going to need those monthly Health Care statements that show how much you're spending why because that's included as income and that will increase the amount of the potential amount of credit that you can get back and lastly we're going to need your forgiveness applications because we have to see how much you actually were forgiven against wages so we can back that out of the calculation uh of PPP so we don't double dip let me give you an example million dollar payroll if you apply uh or you get PPP you get four hundred thousand dollars of PPP and it's all forgiven against wages well we have to deduct that four hundred thousand dollars against that million so now we're working on a basis of a payroll of six hundred thousand dollars again so we don't double dip the government does not like uh to double pay so they gave you the money for PPP they don't want to give you the money again for ERC so we have to back that amount out uh next once we get all the documentation we start the analysis we go through the revenue decline uh calculation analysis and then we go through the nominal disruption analysis through an impact analysis and that means an interview with you on the phone typically about 45 minutes to an hour we're going to ask you a lot of questions because we have to be able to prove that you actually experienced nominal disruption we know about other ERC providers out there that'll say Mr or Mrs business owner you claim you experience nominal disruption great sign here and that's it they're going to file it and God forbid you get audited you have no backup and the government is not going to take your word for it that you uh experience nominal disruption they're going to want to see the analysis they're going to want to see the backup documentation so that's why we go through what we go through once again if we determine you don't qualify you get your retainer back so there is no risk our responsibility our um document collection the calculation the impact study the filing of the 941s and audit protection package at the end of the process once we've received all our money from you our timelines uh are anywhere from two to eight weeks from the time that we collect the documents so once we get all the documentation the clock starts two weeks on a short end because it's just a strict uh Revenue calculation and we don't need to go into impact analysis if we go into impact analysis it's uh it is longer it can be on the longer it can be on the you know the tail end like uh six to eight weeks depending on how complex your your case is now the government is taking anywhere from six to nine months to get the refunds out because they are incredibly backed up last I heard they had 10 million Parcels they're trying to get through this is not filed electronically it is done hard copy through snail mail and they've got to get through it all so they are way backed up we once we determine if we that you qualify we will give you the option should you not want to wait six to nine months to advance you up to 65 of what you qualified for so let's say you qualify for a hundred thousand dollars we'll give you the option to to advance you up to sixty five thousand dollars are there fees involved in that yes there are we'll walk you through all of that once we determine that you qualify and this is just an option you don't want it no problem some about a third of our business owners decide that they want the money sooner they're willing to pay the points and we get them their money two-thirds uh decide that they want to just wait and they'd rather save the money not a problem we just try to make that available to you so on October 19th if you look to the left side of the screen on October 19th there's a memo from the IRS talking about uh what they call ERC Mills um ERC Mills are these pop-up providers it's created because this is so large and there's so much money involved in it this is way bigger than PPP to the tune of about one and a half times the size of PPP so it's created a cottage industry and anybody can be a cop or can be an ERC provider you do not have to be certified you don't have to be accredited um anybody can say they're repeat they're an ERC provider so because the IRS is so backed up they're not approving or denying the 941s or the applications they're processing them so they're going to audit on the back end so they've given themselves five years to go back and audit somewhere down the road so a business could could potentially deal with one of these ERC Mills be told they qualify for credits they don't or be told that they qualify for the maximum credit of twenty six thousand dollars when they might only qualify for ten thousand dollars they'll get their check they'll pay their provider whatever the percentages that that provider is charging and that business owner thinks this is the greatest thing like Dan was talking about since you know his his uh person that uh received the money since Sly spread things are great but that business owner could potentially receive a notice over the next five years saying we want to look at your backup documentation with us it's not a problem you're going to have the backup documentation if they dealt with one of these ERC Mills and they don't have that that's where the problem starts so uh if you are dealing with somebody else and or if you want to um look at somebody else not a problem we're not the only ones out there doing it the only thing I would ask is ask those people how long have they been in business what kind of experience do they have with tax credits and what kind of documentation do you get at the end of the process so omega as I mentioned has been in business with uh for over 15 years we've done well over half a billion dollars in tax credits we have to prove that you qualify so we go we take painstaking measures and sometimes you might go what are these guys doing we're protecting you is what we're doing so we might be asking a lot of questions but there's a reason for that we believe that the IRS is going to key in they're going to see a pattern once they start doing the audits they're going to see a pattern with different ERC providers and they're going to single those ones out that they know are the ERC Mills we are not an ERC Mill and we don't want to get included in that so we're going to do it and if they want to audit some of our work God bless them let them do it because we believe that our work will stand up to the audits now the audits are just starting we've just heard of the first few that are happening none of ours yet but um they are going to happen but again it's going to be a very very very very very small percentage because the the IRS Justice doesn't have the personnel there were 11 million businesses that took PVP they're going to be more businesses that actually take ERC so um while there may a very small percentage we want to make sure that all of our people should they be audited they're going to have the packet they can literally answer the IRS and say here it has the calculations has the uh the narrative that talks about um why we qualified you and it also has all the government orders that relate to why we believe that quality we qualify you um and of course because we want to get the most for you we are going to you know be aggressive but we're also going to stay in the confines of the law we are going to make sure that it stands up when on it should you be audited so I think we got through this in probably about 25 minutes as David said so now we're going to open it up to questions can I make and I piggyback what you said Dan and so I've got two clients who've worked with you Jerry and one in Milwaukee and they sent me a note several weeks back they've qualified for a 52 000 payment and a second company in Louisville Kentucky and it's I smile because he sent me this is the too good to be true email they qualified for a seventy one thousand dollar Credit in the first quarter of 2021 and the 77 000 credit for the second quarter of 2021 right and once again this is for companies that kept employees working during covet right it was it was put part of the cares act it's there for you and just make sure you're working with the right company I just received both a phone call and an email yesterday from one of these pop-up Mill shops Jerry and what the email said is you qualify you know contact us now to get your money I'm a sole proprietor like Dan I have no employees they had done no research we call this spam and so my research with you Jerry showed that you guys have done the due diligence so I can encourage that if people think they qualify to follow up with you right and thank you for saying that David and and for those of you attending if you'll notice I've always I always use words like potentially or may we don't say that you're going to qualify because we don't know right and um and we're not out there you know it says you know get your twenty six thousand dollars the stars have got to be a line for you to get a full twenty six thousand dollars it have we qualified uh businesses for 26 yes rarely though our average is about fourteen thousand dollars per W2 employee some and remember we've done thousands of these so summerless and some are a lot more you know some are up at twenty one thousand dollars per employee some are down you know in in the hundreds uh especially at the real large ones that that paid their employees to stay home and they only paid their benefits or something like that so they might have gotten a lot less um uh credit but they're still getting some you know some benefit from it and if they have thousands of employees because they can do that there's a way to qualify businesses for uh you know a lot higher my point is we don't know if you're going to qualify we'll never tell you you're going to qualify until we start looking into it and that's why you know if you talk to somebody and they say oh yeah you're going to qualify for twenty six thousand dollars we know that it's like buyer beware yeah that makes sense um great presentation and again this is not for everybody I understand that and that's why the emails I sent out I said you know for employers with employees a lot of my clients might have one or two employees they would probably be you know they would have to go talk to their own accountants and things like that but if you have five or more then you'd be you're ready to go so you know exactly what to do and how to do it so anybody on the call if that fits your mold go for it I'm going to post the link here that you can I think you guys should be able to see this um yeah so you you're there's a link in there now where you could go to uh start the qualification process if you want to I'll also send out an email to to everybody um if you're on my page where you're watching this there's a link right here too to start your application so that'll take you to a page that you put some information in how many employees you'll notice that it you know five or more um and then you can kind of just fill this out and then they will like Jerry said they'll get in touch with you and start the process so looks like you have this thing a fine-tuned to say the least anybody else have some questions out there I had Tom on he said oh it's just his employees are his wife and his son-in-law so now Tom Tom you want to talk what no that wouldn't even qualify period for anything so don't even bother right that is correct because they are ownership right so um of course I'm not sure what Bruce is saying move from Ann Arbor maybe because he doesn't have enough employees kind of like me uh I don't have any employees but uh yeah I'm not seeing any questions so if anybody you have questions feel free to reach out to me um I I I'll have the link up here so you can go work on the application if you're so inclined and all I can say is good luck I mean and to repeat that once they finish the application you can turn this around in like 24 hours right Jerry's that your your folks will look at the application then set a time to contact the contractor to talk more right we'll we'll get in touch with you within 24 hours that is absolutely correct and I'd be surprised if it wasn't unless it's at the end of the day I'd be surprised if it wasn't the same day okay cool and uh for 750 totally refundable investment I mean yeah that's uh I think that's a pretty safe bet you know and and it's a bit of an accounting exercise you know collecting all the data information but man we're talking five figures potentially six figures please look at this the the credit which is not a credit it's actually a check it's available if you qualify correct those are the pretty big program this program been around for a while now it's uh it was introduced when the cares act came out and I believe that was in 2020 but it was modified or amended in 2021 in the beginning of 2021 and that's really where it when it started but uh it's kicked in in the last I would say right around uh December January's when so it's been about a year that it's really been very very active okay and the reason a lot of people didn't take care take advantage of it because they most people thought that the uh PPP was the only thing they could do or was that the case at the time it was the case at the time right that changed okay so a lot of people probably haven't kept up with that change or are aware of that change there's been a lot of changes uh and yeah it's been hard to keep up with all the changes especially for you know Layman um and even even for accountants Jerry well it's funny because Most accountants I shouldn't say most there are a lot of accountants that do not um do this because they don't have the bandwidth they've been dealing with forgiveness and all of that stuff two they haven't kept abreast of the regulations and it's it's interesting when I I talk to business owners and they say well I want to bounce it off of my my account and they should but I always finish with let me ask you a question did your accountant call you and inform you about this program that can get you money and the chat and typically they have not so and the reason is because they're not doing it so um a lot of times we will talk to business owners and they'll say oh my payroll company and my accountant told me uh I don't qualify because my Revenue wasn't down but they're not looking at the second path nominal disruption so we have gotten lots of money for businesses that were told initially that they did not qualify and you're you know I mentioned to you Jerry before we got online I spoke with a company in Eugene Oregon and spoke with the bookkeeper and I said did you follow up and she said oh we don't qualify our Revenue increased just what you said and I said did your account mention the disruption of service she said no and I said please give your accountant a call back and ask about the disruption the nominal disruption of service because look I don't know any contractor that wasn't affected by this right yeah some way or another yeah yeah absolutely awesome well very good all right I don't see any questions so you guys thanks a ton for putting this on Jerry thanks for that information um I'll be sure to let everybody and appreciate it you bet all everybody uh I'll get them the link and uh kind of go from there thank you Dan so cool everybody thanks for joining us and we'll see you next time on the designer show this is Dan you got

Elevate Your Chief Architect & Design Business Skills

Reserve your Spot to the 2024 Chief Experts Total Immersion Summit For Chief Architect Users

Outer Banks, NC

March 1 to 10, 2024

Mastering Kitchen, Bath, and Lighting Design BUNDLE - Only $595

Special Bundle Offer: Four Courses for Just $595!

SAVE $1,737

LIMITED TIME ONLY

On-Demand Chief Architect Training

Don't Miss These New Courses With A Simple Goal: "Help You Become A Better Designer"

- Understand And Define The Structural Elements In Building Construction

- "Creating a Plan - Quick Start" course for Chief Architect users

- Define And Draw The Structural Elements In Your Projects

- Discover the Inner Workings of Chief Architect and What it Wants From You

Upcoming Events